Federal unemployment withholding calculator

The Federal Withholding Calculator can show you your potential federal tax withholding amount based just on just the gross amount of your PSERS monthly benefit. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding.

. South Carolina Department of Revenue. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. State law instructs ESD to adjust the flat social tax rate based on the employers rate class.

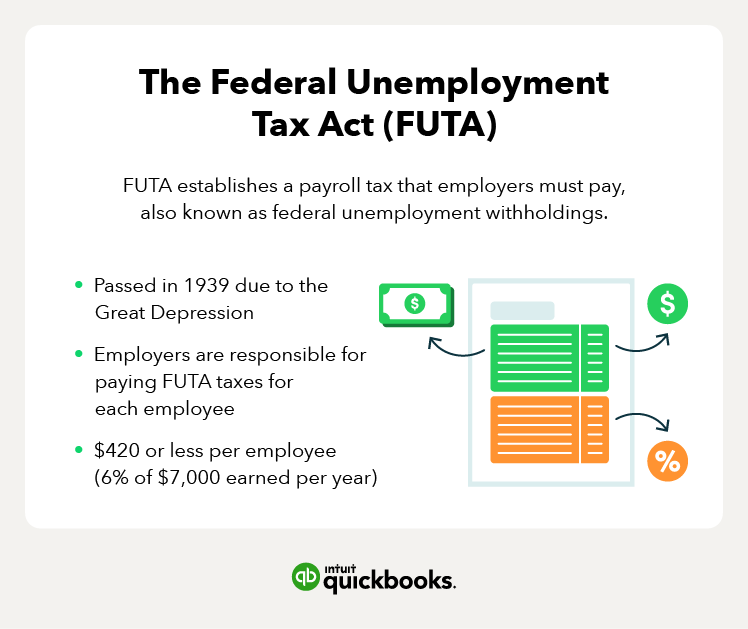

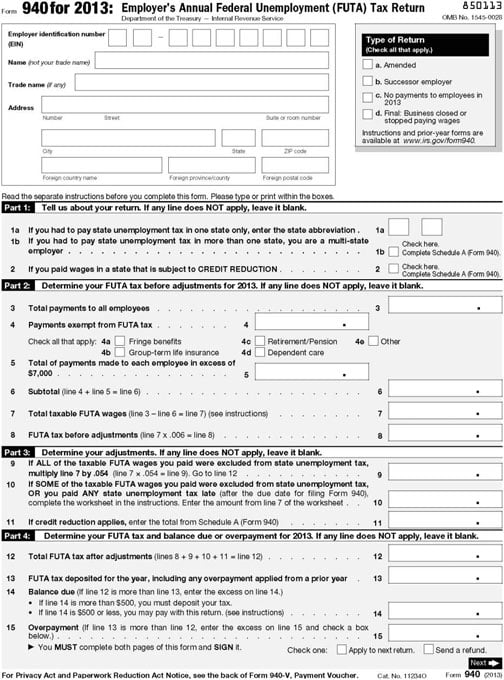

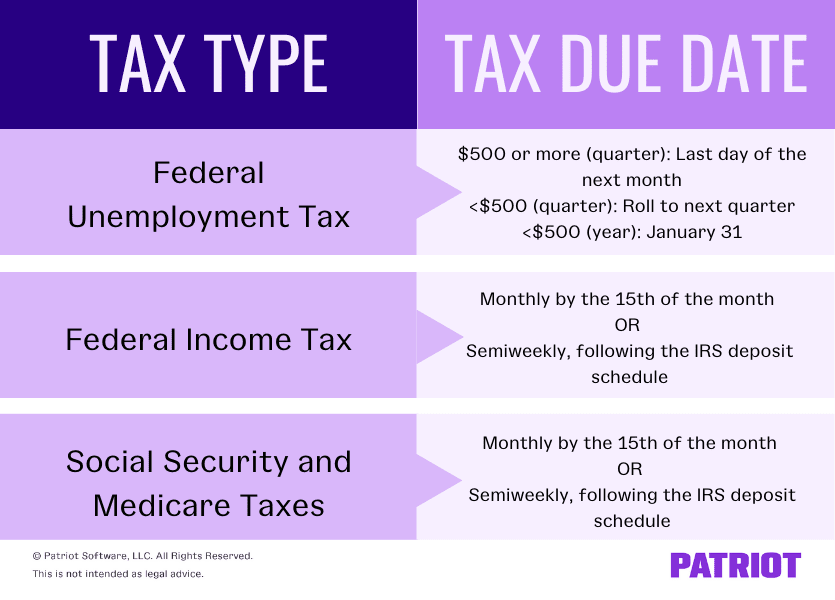

The FUTA tax is 6 on the first 7000 of income for each employee. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding.

State Unemployment Insurance Tax-. Youll need your most recent pay. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Most employers receive a. The FUTA tax applies to the first 7000 of. All calculations for withholding the employee contributions are to be made each payroll period and carried out to three 3 decimal places dropping the excess and rounding to the nearest.

2 This amount would be reported on the appropriate reporting form. How to Check Your Withholding. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Tax was withheld on just 40 of total unemployment benefits paid in 2021 roughly the same share as 2020 according to Andrew Stettner a senior fellow at The Century. We add together the gross wages from the two highest quarters in your base year then we divide by 2. Enter your info to see your take home pay.

This Estimator is integrated with a W-4 Form. Refer to Reporting Requirements. You must pay federal unemployment tax based on employee wages or salaries.

The standard FUTA tax rate is 6 so your max. Columbia SC 29214- 0400. In Washington state this is how your weekly benefit amount is calculated.

1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter. You must pay federal unemployment tax based on employee wages or salaries. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and.

If your company is required to pay into a state unemployment fund you may be eligible for a tax. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. FUTA Tax Rates and Taxable Wage Base Limit for 2022.

The FUTA tax is 6 0060 on the first 7000 of income for each employee. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

How To Fill Out Irs Form 940 Futa Tax Return Youtube

How To Fill Out Form 940 Futa Tax Return Youtube

Federal Unemployment Tax Act Futa Rate For 2022 Pay Stubs Now

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Futa Tax Overview How It Works How To Calculate

Accountants Are In The Past Managers Are In The Present And Leaders Are In The Future Accounting Services Accounting And Finance Financial Management

How To Calculate Unemployment Tax Futa Dummies

Department Of The Treasury Internal Revenue Service Publication 15 Cat No 10000w Circular E Employer S Tax G Tax Guide Internal Revenue Service Employment

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

When Are Federal Payroll Taxes Due Deadlines Form Types More

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Fill Out Form 940 For Federal Unemployment Taxes

Financial Accounting Payroll In 2022 Financial Accounting Accounting Classes Payroll

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube